The net effective rent is the monthly amount the tenant pays to the landlord after factoring in incentives. The term is common when searching for apartments in New York City, especially during the off-peak winter season. This is when landlords increasingly offer rental incentives. You can find a deeper discussion of net effective rent on our rental guide.

Example of Net Effective Rent

Here is a simple example. When a landlord is asking for $3600 monthly gross rent, but is offering 1 month free on a 12 month lease. The net effective rent is the gross * (12 months – 1 free month) / (12 months). In this case, $3600 * 11/12 = $3300 net effective.

This structure is useful for comparing rent in a building offering renter incentives to a building that is not. However, keep in mind the net effective is not guaranteed after the initial lease period – in fact without further negotiation, you can expect to pay the gross after the initial lease period.

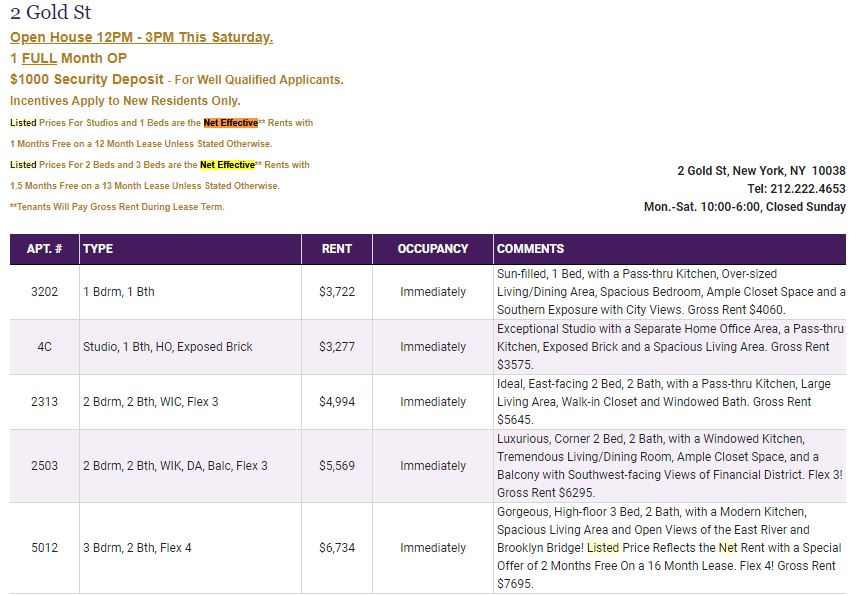

Also, not all calculations are 1 month free on 12 months. This week’s inventory from the 2 Gold Street, a popular financial district high rise, has 3 different structures in the fine print! You get 1 month free on 12 for a studio, 1.5 months free on a 2 or 3 bedroom, except one listing, unit 5012, offers 2 months free on a 16 month lease. In every case, the “rent” column shows the net effective already, so to compute your gross at renewal, you would need to do the math backwards!

Editor’s Note: We updated this article to enhance readability.