Renters insurance is a self-explanatory concept, but is several confusing specifics. Some renters may wonder if they need a policy when renting an apartment, especially in an unpredictable area like New York City. Renters insurance is not always mandatory, but if you’re a renter with a lot a valuables (as most of us are) it is a smart move and good news, it is not nearly as costly as homeowner insurance!

What Is Renters Insurance?

Renters insurance covers your valuables at home if something were to happen in your apartment such as damage to apartment, fire, theft, etc. Most people might think that those things are covered by the landlord, but that is not the case. A landlord’s insurance will cover the building but not specifically your valuables located inside your apartment. Side note, the landlord’s policy will cover appliances that they own in your apartment. A lot of big insurance companies offer renters insurance, so as a renter you have plenty of options to pick from.

Some landlords require that their tenants purchase renters insurance, and will state this in their lease.

What Does Renters Insurance Cover?

So what does renters insurance specifically cover? Obviously, it covers your personal property but let’s look at the specifics. The most common areas that this insurance covers (but this can be different from company to company) are:

Damage to Personal Property

This includes damage to furniture, clothes, electronics, appliances, and so on by fire, lightning, etc.

Theft of Personal Property

If you are so unlucky to be the victim of theft or burglary, a renters insurance will cover the loss of items stolen.

Certain Water Damage

While the damage caused by flooding is its own thing and not covered under renters insurance, the insurance will most likely cover damages to your property caused by a water pipe bursting and any other accidental discharge of water to your property/valuables. If you live somewhere where flooding can be a threat, you might want to purchase flood insurance on the side.

Liability Coverage

The liability coverage will cover any injury to another person on your property. This can also include dog bites if your dog was so unlucky to bit another dog or a human. Renters insurance will not cover your pet when it comes to illness and injuries, so if you have a pet you should also purchase a separate pet insurance.

Additional Living Expenses

In the case of your home getting damaged to the point where you are not able to live in your apartment, renters insurance will cover additional living expenses so you have somewhere to live in the meantime.

What does Renters Insurance Exclude?

There are going to be things and areas your renters insurance won’t cover. But it gets confusing to know exactly what it doesn’t cover. While you’ll get the full overview of what your insurance will cover once you’ve signed up and purchased it, here are some areas usually not covered by renters insurance:

- Damage caused by flooding or any other natural disasters.

- Self-inflicted damage.

- Pet illness and injury.

- Damage to valuables you can’t document for.

- Your roommates.

What is the Monthly Cost?

Renters might be discouraged from getting renters insurance in fear of it being too costly. Actually, according to the data out there not a lot of renters purchase renters insurance. Maybe it is because renters think it will cost them too much? If that’s the case, good news! The cost of a renters insurance is very affordable and way cheaper than a homeowner insurance! On average, renters insurance could end up costing you around $15 – $20 a month, only! You can probably get it cheaper or have it be more expensive depending on the coverage you want, but $15 – $20 a month is a small price to pay to make sure your valuables are safe.

How to Find a Policy:

Not all renters insurance is the same, and renters should use the following guidelines to find a policy that works for them.

Do Your Research

There are a lot of different policies out there, that can cover different things. Find out what you want to be covered and what is the most important for you that the policy will cover.

Go Quote Hunting

Renters insurance is about making renters feel a little bit safer leaving valuables at home, knowing that they are covered from certain events. And this should be a privilege instead of a costly affair. Which is why companies offer renters to get a quote for the insurance before purchasing. Take advantage of that and review several companies and their quotes before committing to one insurance.

Review the Cost of Your Valuables

This can be time-consuming but in order to get the best renters insurance, you should list all of your valuables with an approximate value of each of the things you want to keep safe.

Review the Policy

Last, but not least, make sure to review the policy before purchasing. You will be able to see what your coverage actually covers before purchasing so take a minute or more to review the policy to ensure the things that are most important to you are indeed covered by the chosen policy.

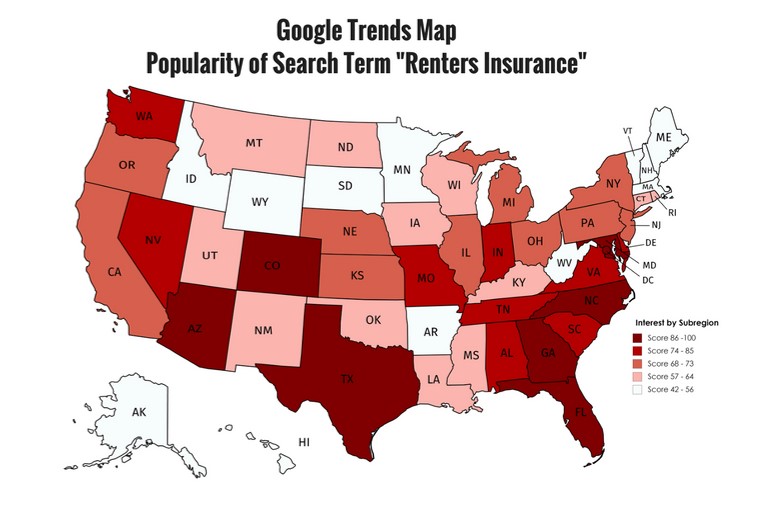

Map Explained

From the map shown above one can see the interest over time for the search term “renters insurance”. We used data from Google Trends to showcase the interest over time on a subregion level, with the data going all the way back from 2004 to now. Google Trends scores search queries from 0 to 100, with the value of 100 being the most commonly searched query, 50 being a query searched half as often, and so on. Using the same metrics as Google Trends, we have mapped the popularity of the search term “renters insurance” by subregion. The subregion where the search term was the most popular was Texas with a score of 100. The subregion where the search term was the least popular was West Virginia who had a score of 42.

Conclusion

Like any individual, renters have a ton of things and valuables stored away in their homes. If anything were to happen inside the apartment a landlord’s policy will only cover the building and not specifically the things located in your apartment. That is why purchasing a policy is a smart move by renters and it doesn’t have to empty your wallet. To see what will be covered and not, do your research so you find the renters insurance that best fits you and your needs!

Editor’s Note: We updated this article to enhance readability.