Living in New York City, specifically Manhattan, is a dream for most people. However, the dream can quickly become a nightmare between the apartment search, the application and approval process, and the physical move. To aid in part of this process, we’ve gathered a list of items to consider before signing the lease for a new home.

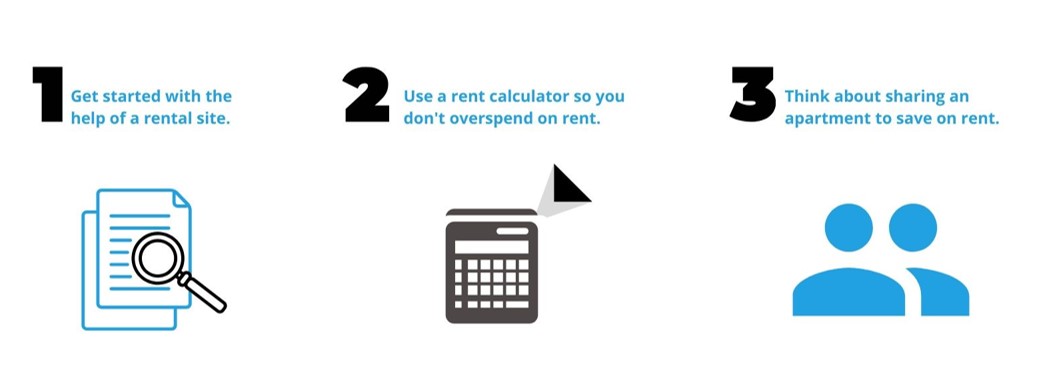

Get Started With the Help of a Rental Site

Renters must research New York City’s market before they move here. If you’re moving here for work, you’ll have a general idea of where you need to live. However, you will not know the rental prices in that area, how the neighborhood contributes to your daily life, or how your commute looks based on trains, buses, and ferry schedules. Additionally, the New York City rental market moves on a yearly cycle, where summer is the busy season for moving. Before signing the lease, you’ll need to read up to understand what to expect as you search for, and live in, an apartment.

Here is where rental sites come in. You will most likely find your next apartment in Manhattan on a rental site and most rental sites offer some kind of extra information on neighborhoods. Here at RentHop, we offer our renters neighborhood guides that describe the atmosphere, history, what the neighborhood offers, and overall stats about the area.

RentHop Research

If you’re incredibly curious about overall market trends, visit our Research center. Our team produces reports throughout the year that analyze pricing and trends across New York City, and other popular markets nationwide.

Use a Rent Calculator so you Don’t Overspend on Rent

It’s important to find an apartment that you can afford. New York City is known for its expensive rent, with some neighborhoods reaching high averages that many tenants cannot afford. Before signing, you’ll need to determine how much you can spend on rent.

For budgeting purposes, you should only spend 30% of your income on rent. If you already have a job lined up before moving, you can easily determine your housing budget. However, if you’re moving to the city without a job, consider the average salary in your industry for your experience level. To be safe, expect to earn a little under that amount, and ensure you have a robust savings account if you do not land a job right away.

After you know your income, you can use RentHop’s rent calculator. Simply input your income, and you’ll receive your housing budget. The page also provides recommendations for rentals in that price range, or you can conduct your own search directly on the platform.

RentHop RentCompare

Additionally, New York City renters can use RentHop RentCompare when viewing apartments. The tool indicates whether the rent is too high based on the area, room size, and amenities throughout the unit and building. If you’re going to overpay on rent, consider why.

Share an Apartment to Save on Rent

For the majority of us, the thought of having an apartment by yourself in prime Manhattan is an unachievable dream, unless you filthy rich or you pick a neighborhood that’s more affordable. However, if you want to live in the midst of it all in neighborhoods such as Midtown, East Village, or Chelsea, you need to be aware that the rent prices is significantly higher than if you were looking for a place on the Upper East or West Side. So before signing the lease, ask yourself: What’s more important, location or price?

If you said price, be aware that the rent prices in Manhattan are high and you don’t necessarily get a lot of space for your money. However, renting in prime neighborhoods in Manhattan can be easier and more affordable if you add a roommate to the mix. If you are really set on renting in a more pricey neighborhood, getting a roommate to share the rent and utility costs with can reduce costs significantly.

Editor’s Note: We updated this article to enhance readability.