nCompass completed its IPO, valuing the company at $7 billion dollars (really $9 billion after accounting for the full dilution of all convertibles, warrants, employee stock options, and other derivatives). For all the early investors, it’s a huge win by any measure, reaching both liquidity and 10x unicorn status. Even most late-stage investors should be happy, especially after the scares of the prior year.

The 2020 failed WeWork IPO, followed by the Covid-19 lockdowns, led to a rather large 15% layoff for Compass staff. Founder and CEO Robert Reffkin predicted a 50% drop in revenues and further pain if nationwide real estate prices fall. Of course, a few months later, the market stabilized and rebounded to all-time highs, helped in large part by loose monetary policy and fiscal stimulus.

Many people ask: what makes Compass different from other public traded real estate giants? Is Compass a brokerage firm valued at many multiples of Realogy and any other brokerage in history? Or is Compass a technology company comparable to Tesla and Amazon?

Compass vs. Zillow – Brokerage versus Listing Portal

We can get the easy comparison out of the way first. Ignoring Redfin for the moment, what is the difference between Zillow and Compass? Does Zillow own Compass as part of the Zillow Group? Absolutely not. The two are separate, publicly traded companies, each with multi-billion dollar market capitalizations. In July 2021, Compass happens to be at $5 billion and Zillow Group at $29 billion.

Think of Airlines

As we discussed at length in our post on best sublet websites, the main difference between Compass and Zillow is that Compass is a single brokerage firm with many agents and offices, but Zillow is a listings aggregation portal, showcasing inventory and offerings from thousands of different brokerage firms. The easiest comparison is to think of your favorite airline. Perhaps United, Jet Blue, Cathay Pacific, or Eva Airways? Even if you have great experiences with all four airlines, you usually won’t being a new flight search by going directly to a single airline’s website or app. You need some sort of portal that aggregates every airline, such as Google Flights, Kayak, Expedia, and the one-time pioneer Hipmunk.

To be fair, some loyal customers DO go directly to one airline’s website when booking, and that is usually because they are elite flyers who both know exactly which flights they want to check, or fly with a single airline frequently enough that they choose their preferred airline even if a competing company has a slightly better option.

Real Estate Application

Neither of these loyalty cases really apply to real estate purchases in assessing Zillow vs Compass. In real estate, the vast majority of people simply don’t buy often enough to form any real loyalties. Even if there is any bond or loyalty formed, the relationship is between the client and particular agent, not the brokerage firm. In fact, when a star agents moves from one brokerage firm to another, they usually expect to keep many of their former key clients (an important topic for another post).

All else being equal, we would normally value a listings portal site based entirely on their traffic and market dominance, and Zillow certainly has a critical mass of leads they can send agents nationwide. When valuing a brokerage firm, you simply look at the amount of deals they close and commissions earned each year, plus any special market advantages they might have in brand recognition, recruiting capability, and internal technology. Compass has worked very hard to differentiate themselves as a brokerage with tons of these special advantage. Let’s take a look at whether there is anything there.

Redfin vs. Zillow

What about Redfin versus Zillow? Are they both listing portals? Does one own the other?

With some similarities to the Compass vs Zillow analysis, Zillow and Redfin are also separate companies, both publicly traded. Redfin’s recent market cap is $6.5 billion, making it more valuable than Compass. However, Zillow is still at least 4x as valuable.

At first glance, the same brokerage firm versus listing portal analysis seems to apply. Redfin is a licensed brokerage firm that closes many deals and collects many commissions, no question about it. But do they behave and operate like one?

Redfin’s Early Days

Once upon a time, Redfin was a startup, and like most amazing startups, they tried many experiments and executed several minor pivots. One of the most incredible things they did was to focus on the customer service experience, above and beyond revenues, commissions, and deal closing. The incredible innovation was to compensate agents primarily based on customer satisfaction, regardless of whether or not the deal closed! Industry experts originally felt this was a downright blunder.

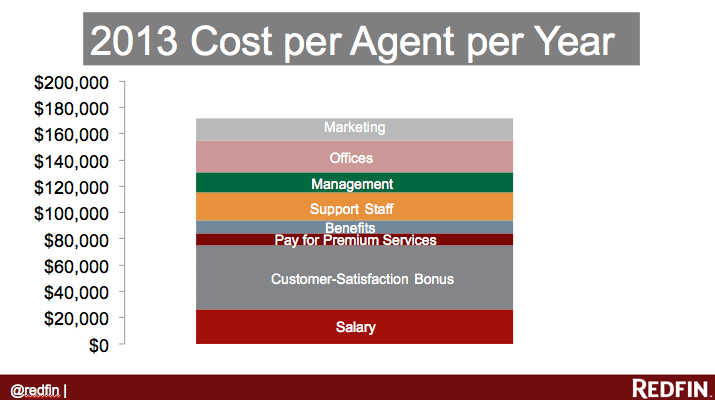

As a brokerage firm, paying agents a commission after each closed deal properly aligns the incentives between company and agent. Commissions account for almost all of the brokerage firm revenue, and the prevailing wisdom has always been to recruit agents who can close a high dollar volume of deals. Why might compensation based on customer happiness misalign incentives?

Most Leads Don’t Close

Most clients have doubts about making a purchase as large as a home. During the heat of negotiation during any stressful deal, emphasizing any small concern can easily sink the deal. Therefore, almost all real estate agents spend most of their energy focusing their client on the positives of the deal, praying all the way through closing that the seeds of doubt never bear fruit. The truth is, even with lots of prequalifying and vetting, most clients that an agent meets will ultimately not close. The actual conversion rate likely hovers between 5%-15%, with the higher end of the range only achieved under the best conditions (and lots of pre-qualifying). Said differently, 85% to 95% of clients are, to put it bluntly, a waste of time. The agent and brokerage firm will not make a penny on the deal, and actually loses money on travel, grooming costs, and mental energy.

Changing the Narrative

Now imagine the brokerage offers you a way to make money on 100% of clients. You just need to make them happy. Real estate agents play multiple roles, including salesperson, mentor, educator, and personal assistant (the later coming up way too often). That means being friendly and professional, meeting them and earning their trust, and ultimately make the customer feel you’ve got their back. In most cases, the easiest way is often to talk them out of the deal, or at least talk them out of over-paying and over-competing to close a deal.

When Redfin first announced this unique model, many industry experts laughed that they would attract exactly the wrong agents – people who were overly diligent, too honest, and unable to close. Fast forward two decades later, and I don’t think anyone is laughing at them.

With both an amazing brand name and a top-tier consumer-facing website attracting many direct leads, it is easy to see that Redfin is more than an ordinary brokerage. Their search technology is arguably the best in the industry. They have comprehensive data coverage for most of the nation, excluding perhaps condo and co-op data in the NYC metro area. Their depth of MLS coverage allows them to break past the usual Delta Airlines versus Kayak comparison. Years of success has given them a source of organic traffic that other brokerages could only dream of having. The key question is, can Compass grow into a Redfin? Is there room for both?

Noteworthy Compass Accomplishments

Compass gained a tremendous amount of market share in about 8 years of operations. They started solely in New York as Urban Compass, initially hoping to revolutionize the rental market before realizing sales were far more lucrative. In the process, they navigated through multiple game-changing shifts in the industry: a shift to No Fee Brokers and OPs, the rise of the 100% firms, and the mid-sized brokerage squeeze.

Compass Reversed the Trend Toward Light Brokerages

For at least a decade prior to the Compass ascent, almost everyone in real estate was talking about the death of the traditional brokerage model. In a world where most leads come from the internet, who needs a fancy office, let alone expensive store frontage?

The New York City market changed drastically, and along the way Compass found itself steering exactly against the tide. Although we focus primarily on NYC firms, similar disruptions happened in many cities and metro areas across the United States.

The 100% Firm and other High Split Models

For a time, a new, light brokerage model seemed inevitable. Light brokerages can offer extremely high commission splits in favor of the agent, relative to the traditional 50% (half to the agent, half to the brokerage). Although sometimes called a 100% firm or high commission split model, in practice the firms offer about 80%, while taking only 20% or less (the ones that say 100% have higher monthly desk fees). The firm fulfills the legal requirement of a brokerage and often provides some technology infrastructure and sometimes shared office space (although it is unlikely. However, the three most fundamental characteristics of a light brokerage are:

- Agents must pay a small monthly fee to continue parking their license, often called a desk fee, even though you never get a desk

- Agents are not required to work full-time and can go for periods without any closed deals. A traditional firm would quickly let you go.

- Agents are largely responsible for procuring a source of leads. You generally pay for your own advertising, although you might be able to take advantage of bulk rates from your firm.

To some, the shift seemed inevitable. REMAX and Keller Williams were rapidly growing their agents nationwide. In New York City, Charles Rutenberg and Level Group, Pari Passu at the time, were among the first high-split firms. Not long after came Oxford Property Group and Spire Group. All of these firms grew their agent counts to well over 100 in short order.

Compass vs. Redfin vs. Discount Firms

Note that Compass is absolutely not a high split firm or light brokerage model. They infamously recruited many of their top agents with a high commission split lure, but those deals are temporary deals. For example, they promised some agents a 90% commission split for the first year, plus a signing bonus and marketing subsidy that totals 6 figures. However, all of those perks are charged as recruiting and agent costs. Their reported $3.7B of revenues includes the commission they would have received on an industry-standard 40% split.

Separately, neither Compass or 100% firms are discount brokerages. Discount brokerages are a somewhat failed model from the 1990s (Redfin started out this way, but transitioned into something quite different, discussed later). In a discount brokerage, the discount goes to the consumers in terms of a commission rebate. Instead of the usual 6% commission when selling a house, 1% goes back to the buyer or seller when using a discount brokerage. ZipRealty and Foxtons attempted the model in the US, along with many clones that ultimately failed. Quite simply, the firms self-select for lower-performing agents, leading to a downward spiral into a zombie company.

The Mid-Sized Firm Squeeze

The big losers over the past decade have been mid-sized brokerage firms. These firms are often owned and operated by the founders on a daily basis, boasting high-touch management and about 50 to 200 agents. Their strength lies in specializing in a particular niche, either a few neighborhoods or a specific style of apartment consumer.

The migration from traditional to light brokerages sent shockwaves through the industry. Traditional brokerage competitors took notice, especially in the mid-sized segment. Even some of the most high-touch, centrally managed firms dabbled into high-split experiments. Ardor NY, once a Midtown powerhouse run by Chris Shiamilli and COO Stephen Love, began offering 3 different agent tracks.

The “Entrepreneurial” plan gives 90% and the “Virtual Plan” gives 90% (how do they differ? who knows). The “Mega Support” model is the traditional, 50% split model, which includes training, subsidized advertising, an experienced mentor, and house leads.

All 3 tracks had access to a firm’s carefully maintained listings database. Unfortunately, only a few years later, Ardor NY folded and liquidated. Back then, most firms offered in-house software and listings database solutions that required a significant labor and capital investment to maintain. Why was it necessary?

Helping New Agents Succeed

Newly licensed real estate agent need a way to gain rental leads, and an open listings rental database is essential to the process. From Day 1, management tells the new agent to pick a neighborhood and spend the day previewing half a dozen open listing apartments for rent. Afterward, the agent compiles all of the photos, notes, and data into advertisements, aka listings, and posts them on consumer websites such as RentHop (for NYC apartments and sublets), RealtyHop (for sales listings), and of course Craigslist (for just about anything).

These advertisements become an asset that the agent will continue to use to attract leads and fill their schedule for days to come. If they ever have an empty day, then it’s time to preview more listings. The listings database makes the entire routine possible. Without access to the city’s open listings, and all of the relevant broker blasts, the agent wouldn’t know where to go or what to show. Often an agent develops a good rapport with a customer, but the initial apartment didn’t quite fit their needs. What does an agent do? Consult the listings database to find similar apartments that are more suitable.

Compass Bets Big on In-house Technology and Data

With experienced tech founders and lots of VC backing, Compass quickly reached mid-sized status in New York City. However, a key part of their strategy was to recruit top agents AND top technical talent. Top agents would bring the listings exclusives and relationships required to continue recruiting agents. Leonard Steinberg, formerly at Elliman, was the first of many top tier poaches in 2014. Compass also scooped up some proptech stars, such as data scientist Sofia Song from StreetEasy (she left two years later in a major tech restructuring).

One unique difference is Compass’s focus on growing their in-house technology, data analysis, and engineering team. It’s a very major expense in an industry already operating under razor thin margins. One of the core questions for investors following Compass is whether the big bet pays off. Is there enough proprietary technology to justify the cost? Are the agents more efficient or loyal after using the Compass platform, or will they leave once the promotional commission split period is over?

Also, what exactly does the in-house solution provide? Is there some long-term moat that gives them an advantage over other brokerages? Or do they have plans to be more than a brokerage someday?

Enter Nestio, Listings Force by RealtyMX, and You Got Listings

Another innovation in the past decade: the open listings syndication engines. While dozens of mid-sized firms struggle to maintain listings databases and proprietary technology, others opt to outsource to Proptech SaaS vendors. In fact, almost every firm large and small uses multiple vendors – the difference is how much you rely on them.

Is the in-house platform part of the core competency and edge over a 100% firm? If not, for only $99 a month, any agent can get access to a reasonable listings database, ad creation, and syndication platform.

Reasons to be Bearish: Consumer Recognition?

With all of the amazing press Compass has received, it’s surprisingly hard to find real estate consumers who name Compass.com as their preferred real estate search engine. People will say Zillow or Redfin all the time. Some have their own favorite smaller sites. Over the years in NYC, we’ve seen New York bits, Skip the broker, Sherpa, who all had an era of popularity. Of course, there is also StreetEasy and RealtyHop, currently enjoying a strong growth spurt.

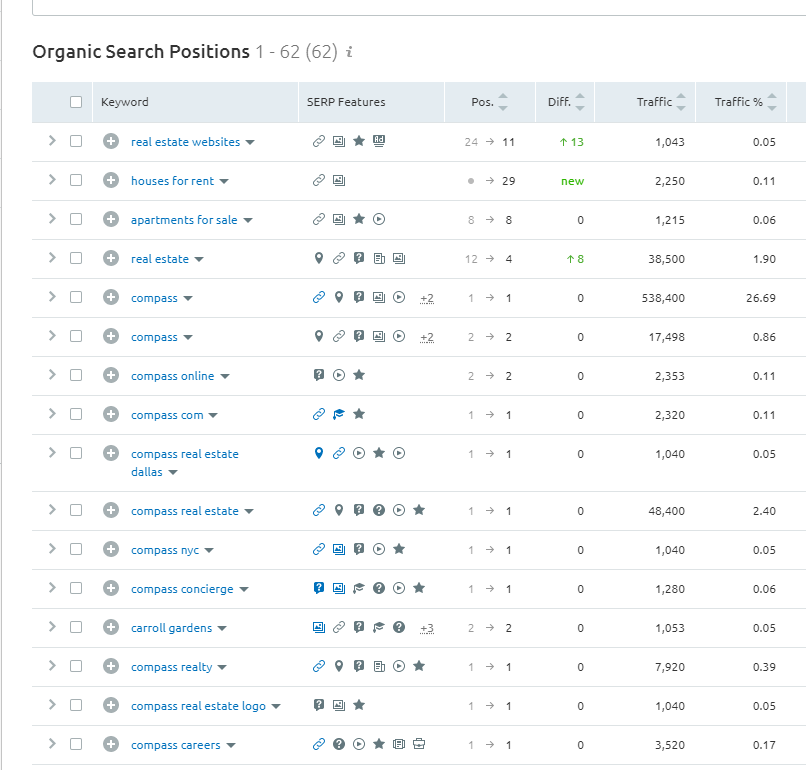

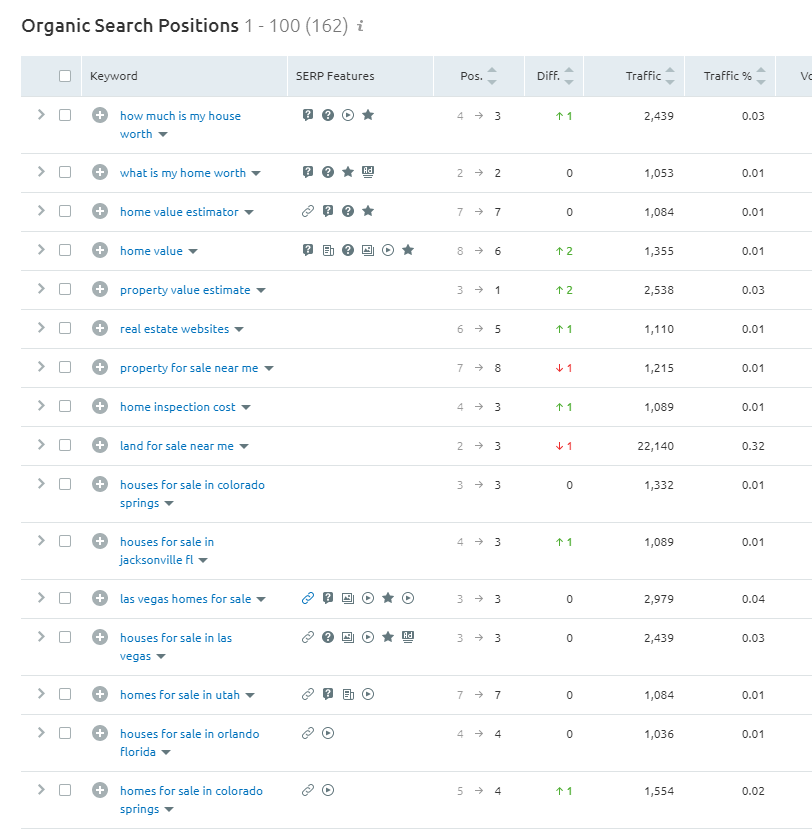

Somehow, Compass never enters the radar, unless consumers found the agent first on another portal. That’s an unfortunate result after spending nearly a decade and tens of millions on the consumer facing portal. Objectively, their SEO rankings fall well short of competitors. Most of their organic traffic comes from people searching for Compass. Branded search is also important and they have done well there – but other than “real estate” which has trended up ahead of their IPO, it is quite lacking in the medium and shorter tail intent-based real estate terms.

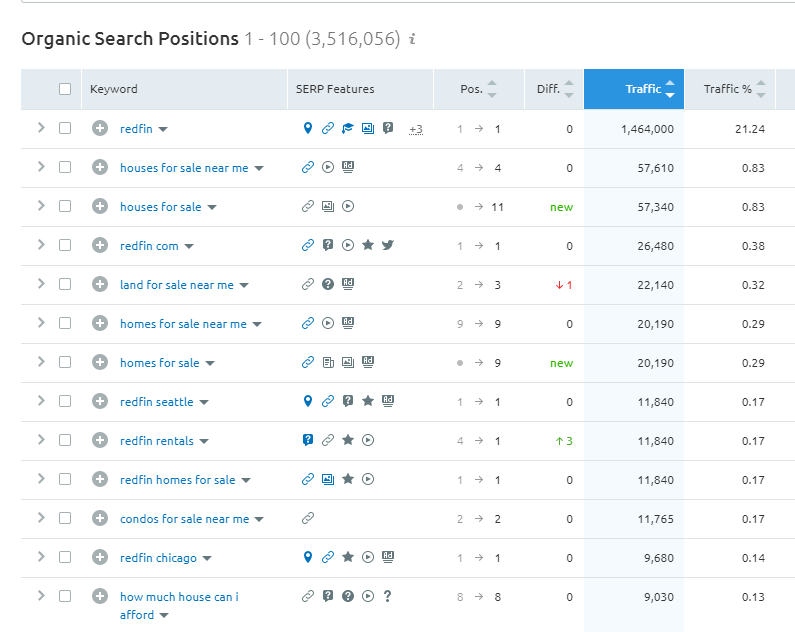

Contrast that with Redfin, which also does incredibly well in branded search, but also in many short tail, competitive terms. First, you’ll notice that the branded search is multiples of Compass in shear traffic. They also rank well in many competitive terms with clear real estate purchase intent. Redfin is also operating a brokerage, but also has a huge focus on the consumer experience.

Real Estate Demand After The Pandemic?

Reffkin himself later said the pandemic might have been helpful for real estate sales in many metro areas. Covid-19 created a permanent shift in real estate demand. Everyone realized they want more space. Larger apartments, larger houses, and more room for the family and kids. RealtyHop data confirms the phenomenon. Housing prices in desirable suburbs are now above their pre-pandemic highs, with a focus on 3 bedroom and larger units.

The RentHop data has very in-depth amount of coverage in dense urban areas. New York City, Boston, Chicago, and San Francisco saw very sharp declines in rental prices throughout the pandemic lockdowns. At first, some landlords held out, hoping the sheltering-in-place would be over in a few weeks. Even then-president Trump initially declared in March 2020 that we would reopen the country by Easter. Unfortunately for city landlords, by summer it was a full-fledged fire sale. Studio and 1BR apartments were going for net effective rents lower than even the post-2008 financial crisis. Even in Easter 2021, with a third of the country vaccinated, we are still seeing a huge supply glut in Manhattan, Brooklyn, and Queens.

How long will the deals last? Will companies resume their office footprints in NYC and other cities? Will they require employees to return to daily commuting, meetings, and required face time? That’s the multi-trillion-dollar question everyone is asking. Stay tuned as we continue to report on real estate re-opening trends.

Editor’s Note: We updated this article to enhance readability.