Do you have a credit score lower than 650? Have you ever gotten denied for rental applications? Renting can be incredibly challenging when you have a bad credit score. From a landlord’s perspective, a bad credit score usually means late payments, or worse, financial losses. Landlords, therefore, may be reluctant to rent to someone who has a low credit score, or they may require more security deposits. However, just because you have a bad credit score, it does not mean that you will not be able to rent. In this post, we will go through everything you should know when it comes to renting with a bad credit score.

What is a Credit Score?

In case you are unfamiliar, a credit score is a statistical three-digit number that predicts how likely a consumer will repay his or her debts. Landlords utilize credit scores to see if renters will be able to pay rent on time. Credit scores range from 300 to 850, and a credit score of 700 or above is generally considered good. With proof of income, a valid photo ID, and a good credit score, a renter should be able to apply for an apartment without difficulty.

What is a Bad Credit Score?

Most landlords look for credit scores above 700, or at the very least above 650. If your credit score is below 700, you might find renting more difficult. That being said, credit score requirements vary depending on the class of the residential building, neighborhood demographics, and landlord’s discretion. A landlord in the Financial District might establish a 720 credit requirement for his luxury condo, as rental prices are in general higher in the neighborhood, and it is full of renters who generate a significant amount of income with excellent credit scores, making renting more competitive.

On the contrary, a landlord in Jamaica might be less strict, as the monthly rent is lower, and there might not be many qualified renters if he or she sets a higher-than-usual credit score requirement. Therefore, before you start checking out apartments, the most important thing is to identify the right neighborhoods by looking at rent level and rental supply. Many rental sites, like RentHop, provide quarterly rent reports — these definitely come in handy!

Tips for Renting With a Bad Credit Score

Once you have identified the neighborhoods, you can then shift your focus onto apartments. A bad credit score might hurt your chances of getting approved. However, there are still ways to get an apartment, such as:

1. Focus on Properties Owned or Managed by Independent Landlords and Property Managers

Institutional landlords, such as Related in New York and Veritas Investment in San Francisco, tend to have strict application processes, whereas independent landlords are in general more adaptable when approving renters. They care about whether tenants will cause damage to their properties, and whether they are trustworthy. Remember, your credit score is not the only thing — your background matters, too. Therefore, if you have a bad credit score but have no red flags in your background check report, chances are that you will still be able to find an apartment!

2. Look for Sublet or Roommate Arrangements

People looking to sublet their apartments are usually more flexible when it comes to credit scores, so long as the landlord does not require the sub-tenant to go through credit and background check. People looking for a roommate might also be open to sharing an apartment with someone without checking his/her credit score, as long as that person has enough cash to pay rent.

3. Offer to Pay More Security Deposit

Editor’s Note: New York City renters cannot use this strategy after 2019 legislation that prohibits the landlord from accepting more than two month’s of rent at the start of a lease.

Remember, cash is king. If you have a bad credit score but have extra cash, you can always offer to pay more security deposit. Generally, a security deposit is one to two months’ rent, and it protects the landlord if a tenant causes damage to the rental property or fails to pay rent. By offering to put down more security deposit, you lower the risks, making it easier for the landlord to approve you.

4. Find a Co-signer or a Guarantor

You can ask anyone to be your guarantor, as long as they make 80x the monthly rent. Typically, a close friend or family member will more likely agree to help. You also have the option to pay for a guarantor through a private equity or insurance firm. However, note that the fee for a guarantor can be anywhere between 85% and 110% of one month’s rent, and once it’s paid, you will not get it back. You can, however, get the security deposit back. It might, therefore, be more reasonable to pay a higher deposit instead of paying extra to secure and rent an apartment.

5. Offer to Pay Rent Upfront

Editor’s Note: New York City renters cannot use this strategy after 2019 legislation that prohibits the landlord from accepting more than two month’s of rent at the start of a lease.

Some renters offer to pay one year upfront to get a better deal. Similar to paying more security deposit, paying rent upfront lowers the risks a landlord has to take. If you have a bad credit score but have enough cash to make one large payment at a time, try negotiating with the landlord by offering to pay six months’ rent ahead of time, or even one year upfront.

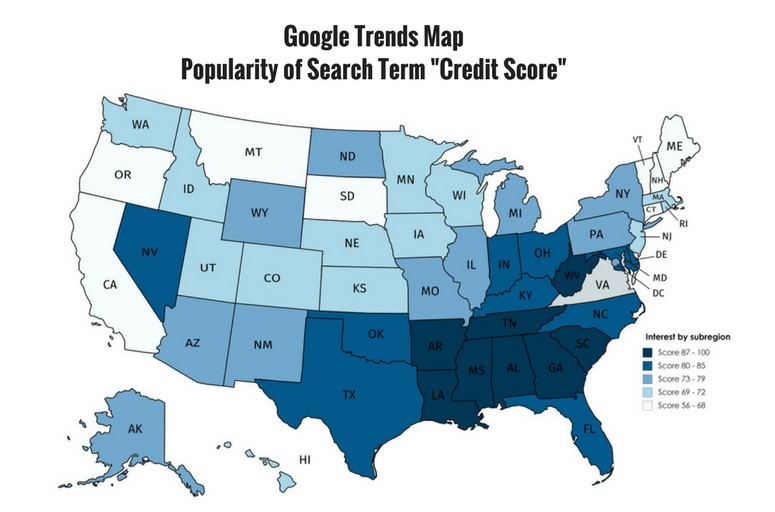

Map Explained

From the map shown above one can see the interest over time for the search term “credit score”. We used data from Google Trends to showcase the interest over time on a subregion level, with the data going all the way back from 2004 to now. Google Trends scores search queries from 0 to 100, with the value of 100 being the most commonly searched query, 50 being a query searched half as often, and so on. Using the same metrics as Google Trends, we have mapped the popularity of the search term “credit score” by subregion. The subregion where the search term was the most popular was Mississippi with a score of 100. The subregion where the search term was the least popular was Oregon who had a score of 56.

Conclusion

For those who don’t have any credit history, the tips we mentioned earlier work, as well. Additionally, If you are a student, you can reach out to local international student organizations, or speak with the international student advisors at your school. If you are a working professional relocating to the U.S., your company is always there to help. Be sure to reach out to the HR department before starting your apartment search. Some companies partner with third-party corporate housing providers, and some others operate their own corporate housing. Both are great housing options!

Editor’s Note: We updated this article to enhance readability.