New York City consistently hosts a competitive and expensive rental market. With the median rent citywide at $4,295, there are plenty of renters looking for a deal. However, it is not always simple to find a cheap apartment by scrolling through listings. There are still changes for renters who are not on government housing programs, like Section 8, to find affordable apartments. The NYC Housing Lottery offers units throughout the city at competitive prices based on their location.

What is the NYC Housing Lottery?

The NYC Housing Lottery is a system of affordable housing opportunities. The city’s Housing Preservation and Development (HPD) and Housing Development Corporation (HDC) oversee the program. Private property owners cooperate with the program to offer affordable housing units in their buildings across the five boroughs. Applicants can choose between rentable units or homeownership opportunities.

How Does the NYC Housing Lottery Work?

Prospective applicants must meet a set of criteria to apply for a lottery. They’ll need to fit the household size and income requirements for the building, and this differs based on the neighborhood. A building’s income requirement reflects the area median income (AMI) for that area. HUD determines the AMI for an area, and then determines the rent for a unit at a percentage of the area’s AMI.

Some renters find that certain neighborhoods with a higher median income then have higher income requirements. Additionally, the units in the building may have high monthly rents compared to what some renters deem as affordable.

Who Wins the Lottery?

The NYC Housing Lottery is a random draw, where only some applicants hold more preference than others. After the application period ends, the applications each receive a random number. The system draws numbers randomly, selecting winners.

The program’s Marketing Agents review the applications, starting with preferences, to ensure they fit the criteria for the unit.

Preferences for Certain Applicants

Anyone can apply for the housing lottery as long as they meet the building’s specific criteria. However, the program gives preferences to current New York City residents. It gives additional preference to those with hearing, mobility, or vision impairments, current community Board residents, and municipal employees. Certain lotteries can also have their own specific preferences.

Those who receive rental subsidies can also apply to lotteries as well. They do not need to meet the income requirements as long as the voucher covers the amount of the rent.

View Housing Lottery Availabilities

There are several steps prospective renters can take to apply for the lottery.

Access NYC Housing Connect

Renters who want to apply for the NYC affordable housing lottery will need to create an account with NYC Housing Connect. This is the portal where renters create a profile and then submit it for different housing lotteries. Anyone can look for available lotteries without creating an account. However, someone planning to apply will eventually need to create an account to submit an application.

Review Open Lotteries

The lottery usually offers several available options at a given time, and each building has its own deadline. Renters can search for units based on their income, household size, and preferred rent. They can further modify the search for neighborhoods, amenities, bedroom count, and nearest subway line, similar to any other apartment listing platform.

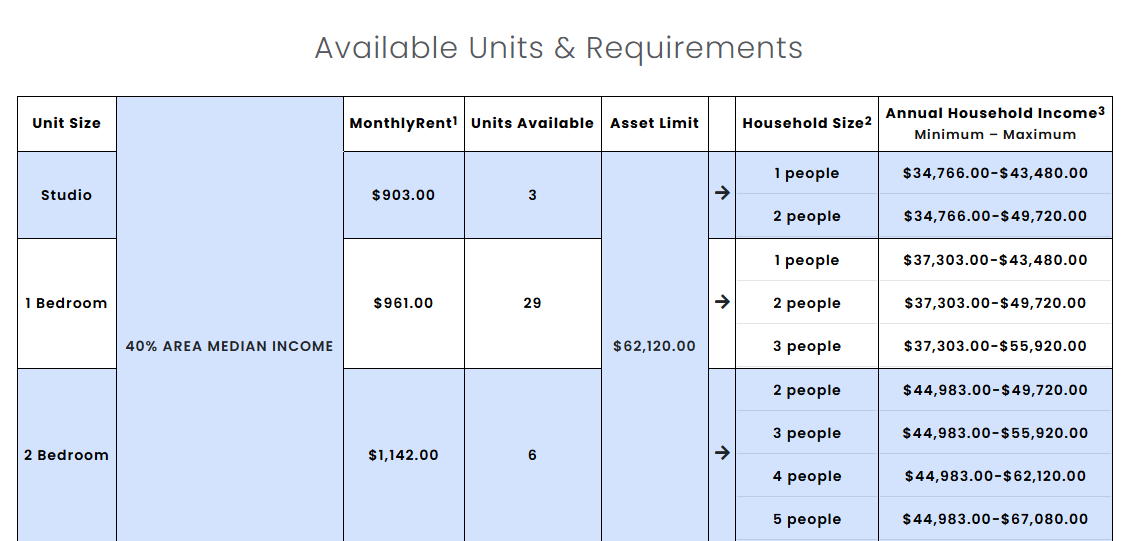

The appropriate housing lotteries appear on the site, and renters can click on the cards to learn more about the building and available apartments. What is unique about the housing lottery listing details is the income and availability breakdown chart. This chart describes the income and household size requirements for the available units. Here is an example of a chart on a housing lottery in Queens

In the above case, a single renter looking for a studio apartment in this building must earn between $34,766 and $43,480 a year. Alternatively, three people looking to rent a one-bedroom apartment must make between $37,303 and $55,920 yearly. Prospective applicants do not need to pay attention to the whole table but can find their specific situation and look at the respective annual household income bracket.

Additionally, renters should note they cannot have assets that exceed $62,120.

Varying Incomes Based on Area

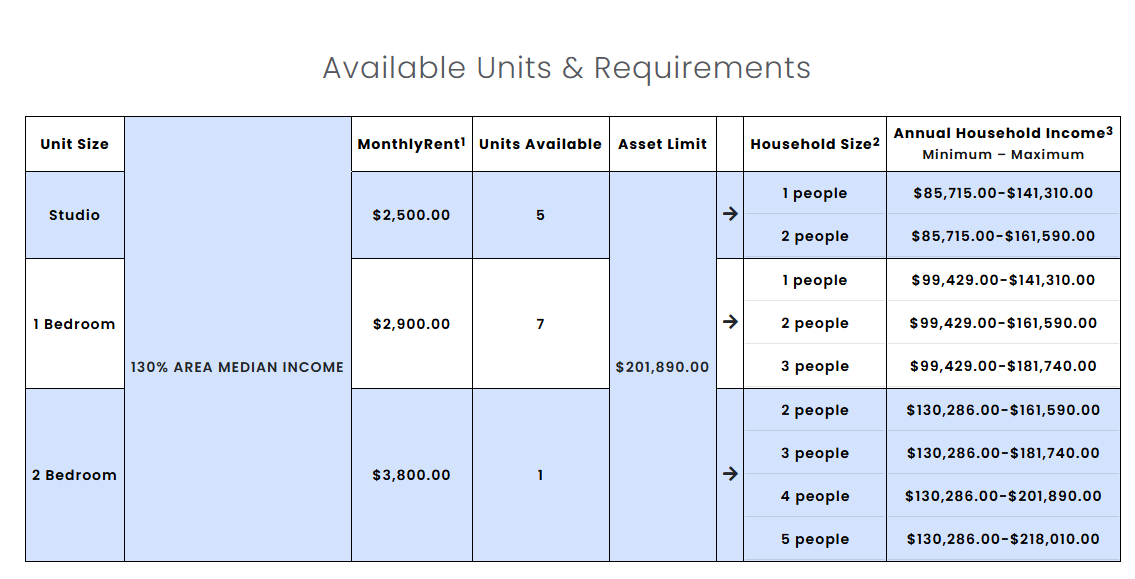

Since the annual household income range depends on the income of the area, different housing lotteries have their own income requirements. The above example highlights a building in an area with a lower median income. Downtown Manhattan paints a different picture:

In this Chelsea building, two renters looking to share a one-bedroom apartment for $2,900 must make between $99,429 and $161,590 annually.

Varying Incomes Within a Building

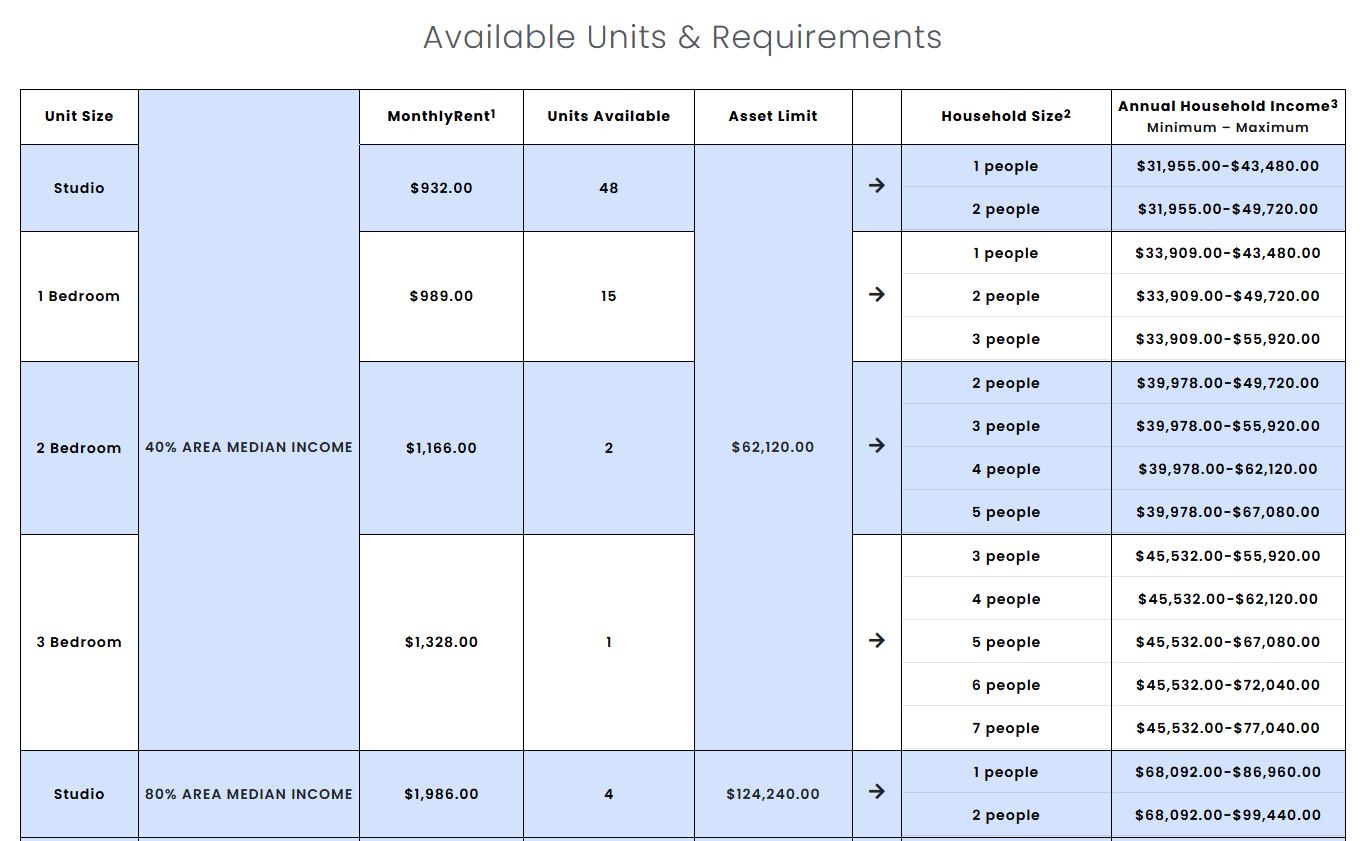

There are even scenarios where one building offers different rents based on the renter’s income. The buildings propose varying rents and incomes based on numerous percentages of the AMI. In this example, renters with a higher income can still rent a unit, just at a higher rent price:

Therefore, many single studio renters have a chance to rent in the building. Someone with an income between $31,955 and $43,480 would pay $932/month. However, someone with an income between $68,092 and $86,960 would pay $1,986/month.

Learn more:

Applying for the Housing Lottery

Interested renters can submit one application per available housing lottery, and they have two ways to submit. Applicants can create an account online or submit a paper application by mail. Renters do not have to pay anything to apply but may need to pay for a credit check, as is standard with most application processes.

Complete Basic Information

The portal asks for information about each person living in the apartment. Applicants must confirm their current address, answer some questions about themselves, then input their current income. Renters can skip over any question to progress to the next step and then return back at a later time.

Submit the Application

After a renter completes their profile, they can browse the website for applicable housing lotteries. Once they’re on the page, it’s very simple to complete an application. They’ll click the “Apply” button and then verify their household size and income information. After they confirm, the system submits their application.

Applicants must return to their housing portal any time their income changes, as it could make them ineligible for the lottery.

Waiting to Hear Back

Many New York City residents and renters-to-be dream of getting a lottery unit. It’s called the housing lottery for a reason! Applicants should expect to wait months to hear if they’re selected as a winner. In many cases, applicants do not hear back if they’re not selected for the lottery. However, they can see the status of their application on their account dashboard.

When the program selects a winner, they’ll reach out to confirm documentation. This information mirrors that of a typical apartment application process. Renters must submit their pay stubs, tax returns, ID, asset information, and proof of address. Those who get to the document submission phase will receive a rejection letter if they are not selected for the program.

Application Accepted

When the program accepts an application, that person has a finite amount of time to move into their new apartment. It’s crucial to understand the move-out terms of their current lease. In many cases, renters will sublet their current unit or break their lease to move into the lottery unit. Due to the program’s extended timeline, it can be difficult to match an application up with a lease end date.

Conclusion

The NYC Housing Lottery is an appealing opportunity for many renters across the city. It provides the opportunity to live in an attractive unit that usually has building amenities. However, the application process is quite competitive, and renters must meet specific criteria to apply for an open lottery. Those who wish to live in a lottery unit should consistently check the program’s website to apply for open lotteries.