The COVID-19 pandemic has dramatically altered life in New York City. The MTA system grapples with billions of dollars of deficits with historically low ridership, and many people, who once called New York City home, are now breaking their leases and leaving the epicenter due to concerns over a potential second wave, burden of high living costs amplified by unemployment, and changes in company remote working policies.

After a few painful weeks with severe declines in leasing activities and high vacancy, the NYC rental market seems to finally see the light at the end of the tunnel. While still slow compared to previous years, the rental market has shown some signs of recovery in the past month, including more inventory hitting the market. In this report, we will analyze the current state of the rental market and offer some insights for people who are looking to move in the coming weeks.

For the First Time in Years, Rents Are Dropping

Calculated using thousands of listings advertised in the past 30 days (May 12 to June 11), the median 1BR rent in New York City currently sits at $2,645.3, down 1.3% from $2,681 during the same period in 2019. This downward pressure is largely caused by reduced demand and an increasing amount of rental concessions offered by landlords grappling with tenant retention and high vacancies. The anemic demand and competition for tenants are forcing some landlords to double their incentives, going from 1 month free to 2 months free on certain units and lease terms.

We are also seeing a growing number of no-fee apartments on the market, whether advertised by rental agents or directly by landlords. Prior to the pandemic, around 58% of the listings on RentHop were no-fee. This number has since increased to 64%.

For those who are staying in the city with expiring leases, now might be a good time to start your apartment search. We expect that the rental trends will continue as New York City struggles with unprecedented job losses, an outflow of residents, and the economic turmoil due to the coronavirus lockdown.

Inventory Flows Back In, Approaching the Pre-Pandemic Level

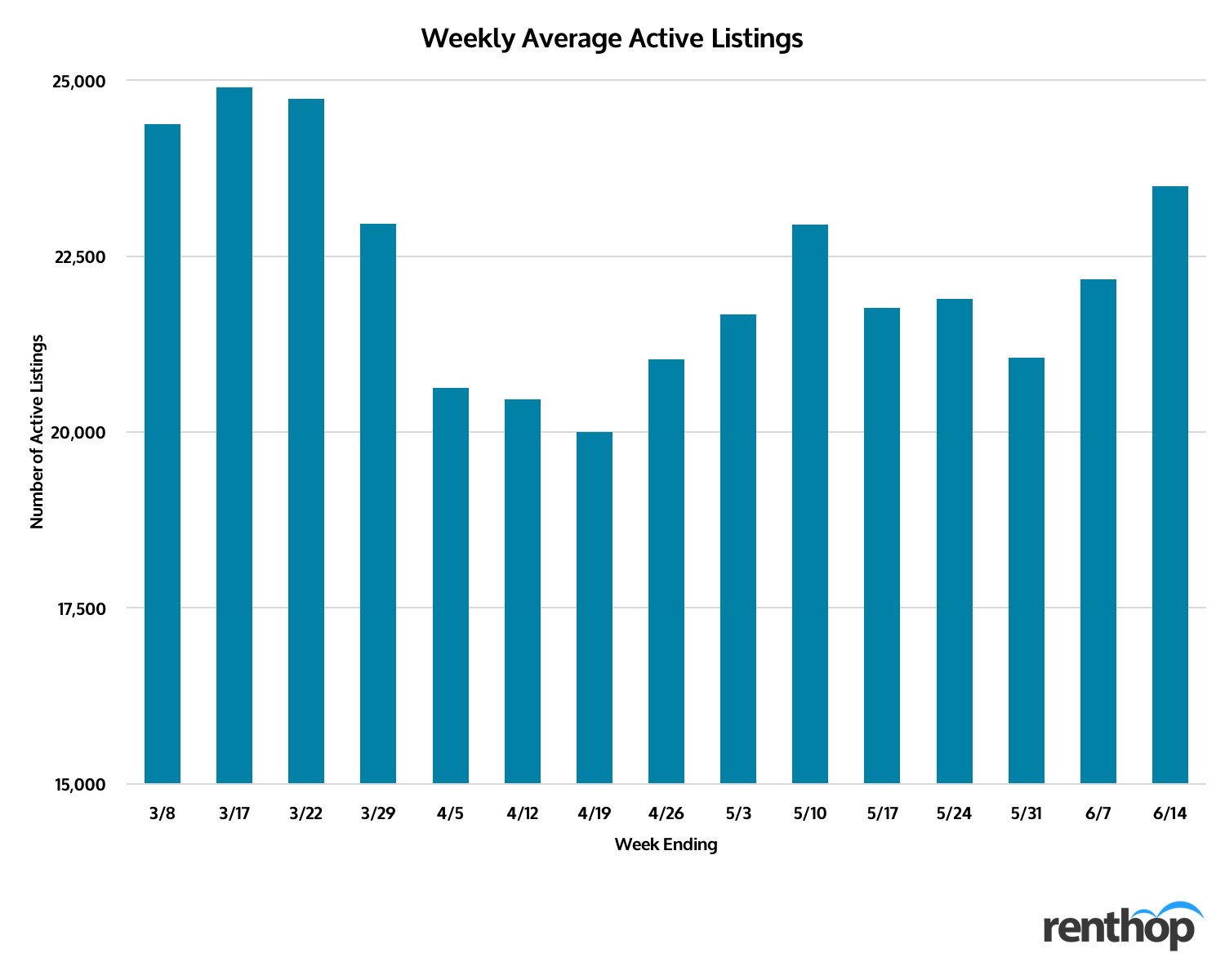

While April has historically been the beginning of busy real estate sales and rental seasons, the market has been flat this year. Due to the COVID-19 lockdown and pause of real estate showings, the number of active listings on RentHop dropped dramatically within a week after the start of the stay-at-home order. By mid-April, the number of active listings on RentHop had lowered 20% to just around 20,000 on average each week.

Since then, inventory has been growing steadily. The number of active listings first peaked the week of May 4 to May 10 since COVID-19 and has generally been trending upward. This implies that inventory is now flowing back, and renters now have more options to choose from.

Renter Inquiries Recovered to the Pre-Pandemic Level

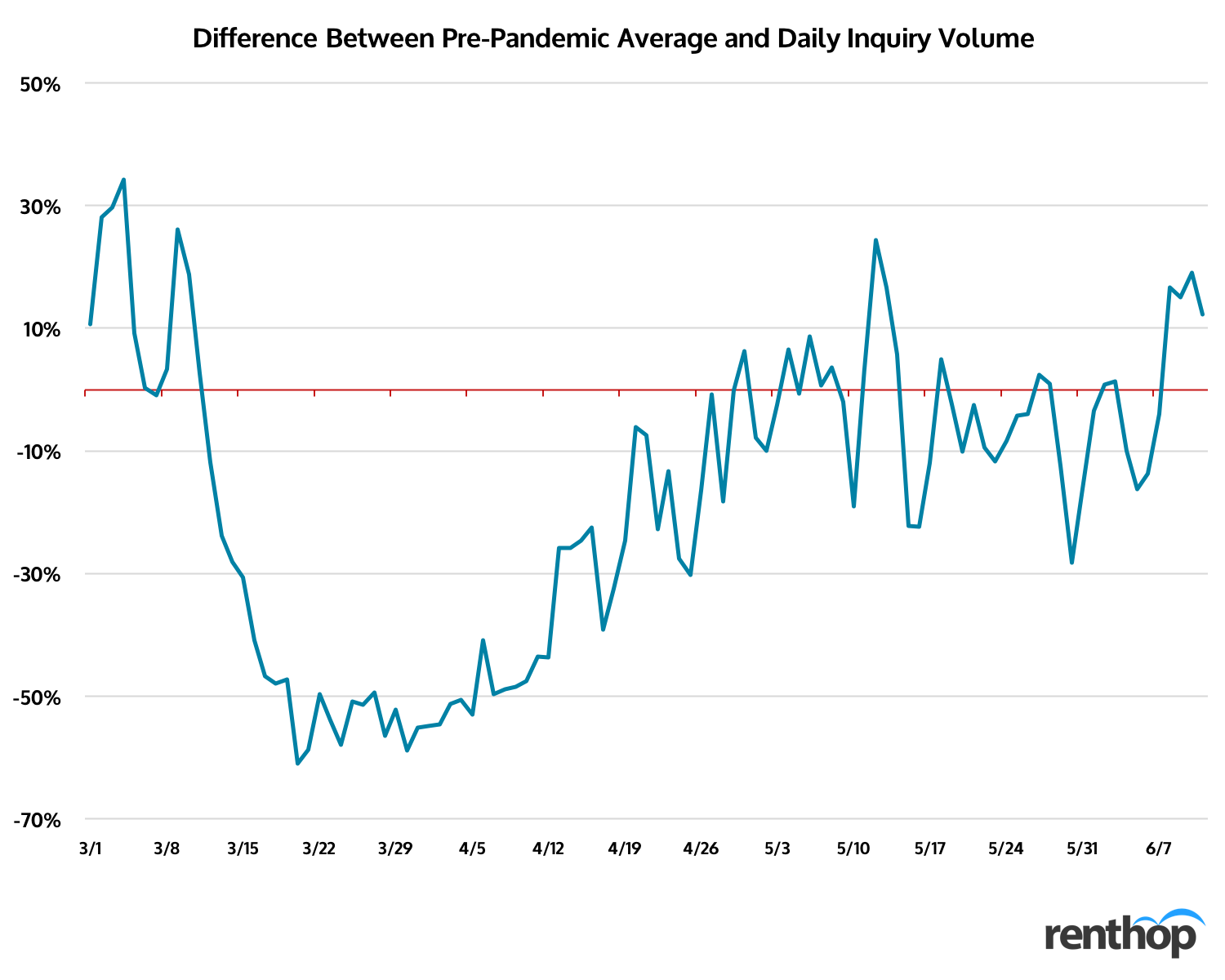

Unsurprisingly, the coronavirus outbreak exerted downward pressure on the rental market in the city of New York. Daily inquiry count started dropping exponentially in early March, and by March 20, the day when the PAUSE order was announced, the daily renter inquiry count had fallen over 60% below the pre-pandemic daily average.

But things quickly started to turnaround by early April. This upward trend continued through May, with May 12 being 26% higher than the daily average prior to the COVID-19 outbreak. And while the recent BLM protests have had an impact on market activities, generally speaking, the number of renter inquiries is reaching the pre-pandemic level. We expect this upward trend to continue in the coming months, driven by pent-up demand as people who have held off moving are now restarting their apartment search process.

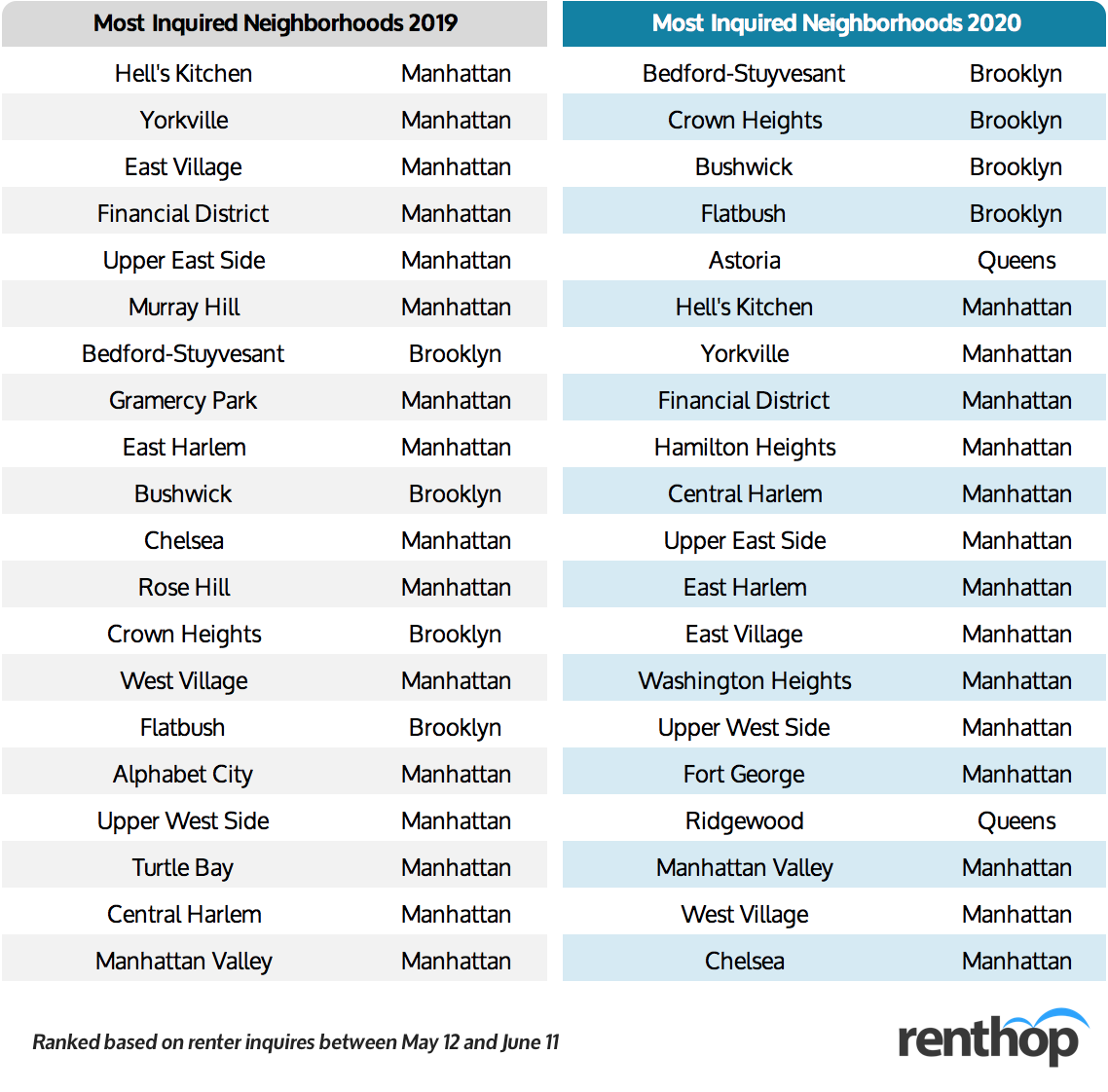

Leads, however, seem to be shifting from Manhattan to Brooklyn. As shown in the chart below, the top 5 most inquired neighborhoods last year were all Manhattan neighborhoods, such as Hell’s Kitchen, FiDi, and the East Village. The rankings changed drastically this year. Four out of the top five neighborhoods are located in Brooklyn, and the fifth one is Astoria, Queens. This shift might be evidence that the city may be seeing an outflow of residents from Manhattan to more affordable and less populated neighborhoods in outer boroughs.