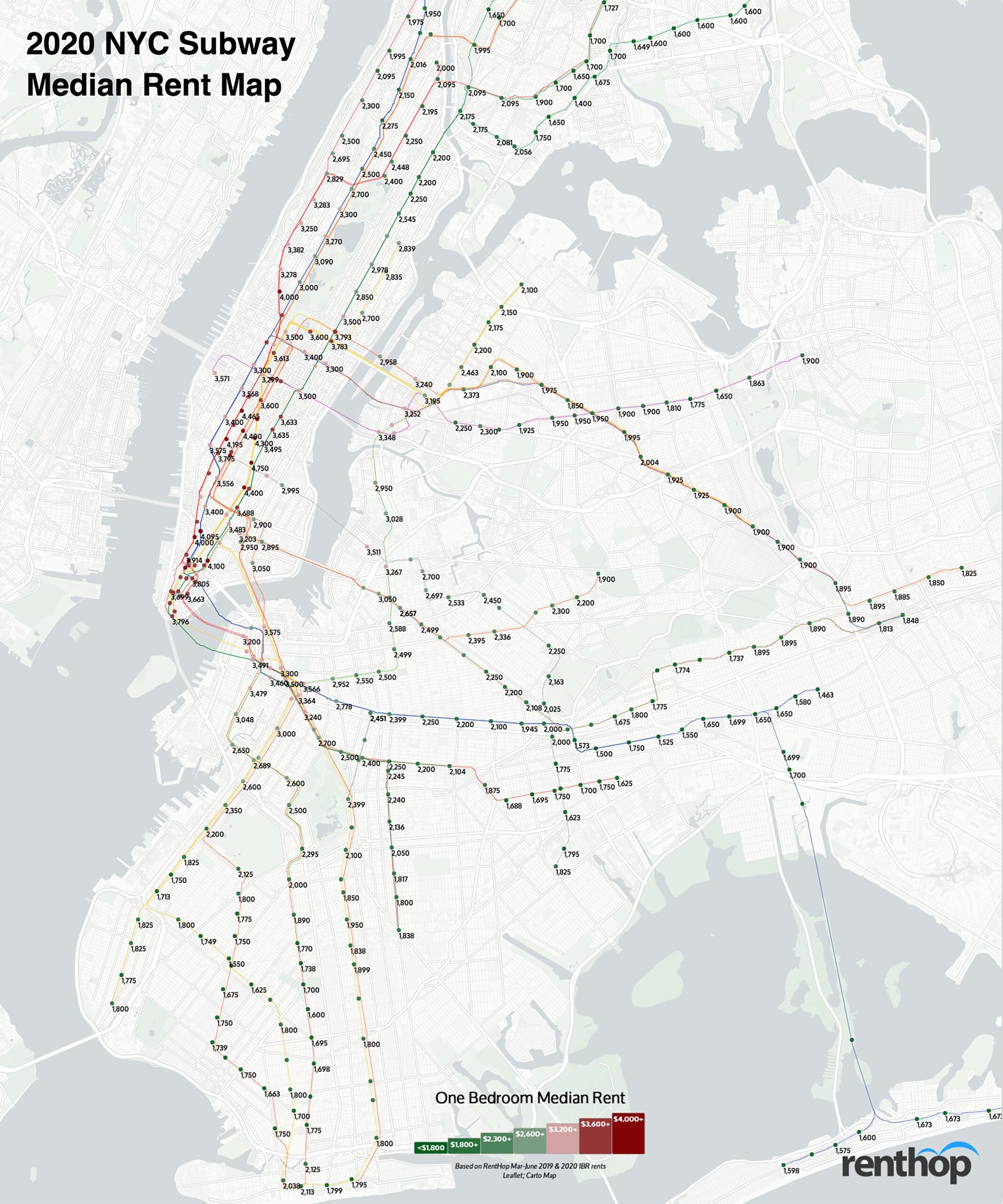

New York’s MTA subway system is an integral part of most New Yorkers’ lives. With as many as 5.5 million riders each weekday, it truly is the backbone of the city. It should be no surprise that it is one of the first things that people consider when looking to rent an apartment. Proximity to the right trains means shorter commutes and more time spent doing what you love. RentHop’s data scientists love maps and rental data, and so we’ve mapped out rental prices by subway stop to assist in your apartment hunting endeavors.

Our key findings this year include:

- Rents remained the same around 28 MTA stops, increased at 257 stops, and fell at 159, or 36%, stops. This number is 10% higher than in 2019.

- As landlords were pushed to offer more concessions in response to the lackluster market performance caused by the pandemic, more stops in Manhattan this year experienced price cuts, including 28 St ($3,635, -11.3%), 34 St – Herald Sq($3,600, -7.6%) , 86 St ($2,978, -6.7%) , and Times Square ($3,299, -5.1%).

- Even with a significant YoY decrease, Union Square continued to be the most expensive stop in the NYC metro area. Median 1BR rent at this stop currently sits at $4,750, 6.8% lower than the same period in 2019.

- New developments continue to be a key driver of rental rates. In Brooklyn, median 1BR went up at several stops, including 36 St ($3,050, +9.1%) , Hewes St ($3,050, +9.1%), and Marcy Av ($3,150, +5.0%).

The Interactive Map Below Shows All Rents, Stops, and YoY Price Fluctuations

Major subway hubs like Union Square, Fulton Street, and Atlantic Ave/Barclay’s Center give nearby residents flexibility and convenience when traveling or commuting to different places. They also make it easy to convene and get home from anywhere after a long day of work. It’s no wonder these subway stops ranked among the most expensive stops on the RentHop subway rent map.

Median 1BR Rents at Major NYC Subway Hubs

- Union Square 14 St (4/5/6/L/N/Q/R/W) – $4,750, YoY -6.8%

- Times Square 42 St (1/2/3/7/N/Q/R/S/W) – $3,173, -2.4%

- Grand Central (4/5/6/7/S) – $3,500, -2.8%

- West 4 St (A/B/C/D/E/F/M) – $3,556, +7.9%

- Herald Square 34 St (B/D/F/M/N/Q/R/W) – $3,600, -7.6%

- Fulton St (2/3) – $3,824, +2.9%

- Fulton St (4/5) – $3,800, +2.8%

- Fulton St (A/C/J/Z) – $3,805, +3.0%

- Jay St – Metro Tech (A/C/F/N/R/W) – $3,523, +0.4%

- Atlantic Ave – Barclay’s Center (2/3/4/5/B/Q) – $3,364, -2.4%

- Atlantic Ave – Barclay’s Center (D/N/R) – $3,452, +0.1%

- Broadway Junction (A/C/J/L/Z) – $2,000, +6.7%

- Jackson Heights – Roosevelt Av / 74 St – Broadway (7/E/F/M/R) – $1,950, +2.6%

36% of MTA Stops Experienced Rent Drops, 10% More than Previous Year

2020 has been a rough year for New York. Due to the COVID-19 pandemic, the unemployment rate in the city skyrocketed 18.3% as of May, according to City Comptroller Scott Stringer. This inevitably had a severe impact on real estate, pushing down rental rates across the city. As people relocate to other metro areas and suburbs, landlords across the boroughs are having trouble filling up the vacant apartments, especially those who own and operate luxury rental buildings.

Compared to only 115 stops in 2019, this year, 159 stops, or 36%, saw price reductions, some of which are in the wealthier neighborhoods in the city. Median 1BR rent dipped 11.3% at 28 St (6 Train), as luxury rental buildings offered more concessions to attract new tenants, including Prism at 50 East 28 Street (YoY -5.2%) and Instrata Gramercy at 290 3rd Ave (YoY -9.3%), which doubled the concessions from one month’s free to two months. Similarly, buildings around 34 St – Herald Square also increased incentives, including EOS at 100 West 31 Street and Epic at 125 West 31 Street, which in turn drove down the rents by 7.6%. Stops in the Upper East Side also experienced notable price fluctuations, with median 1BR rent decreased 8.4% around 96 St (Q) and 6.7% at 86 St (4/5/6).

Gentrification remains a key driver of NYC rental rates. Median 1BR rent jumped 10.1% at 36 St stop (D/N/R Trains), from $1,998 to $2,200. This fluctuation is likely due to the Hyland, a new development launched early this year located at 194 21 St in Brooklyn that features bike storage, gym, parking, and a modern roof deck. Meanwhile, median 1BR rent rose 9.1% at Hewes St (J/M) and 5.0% at Marcy Ave (J/M/Z) respectively, mostly driven by the DIME, a 23-story, 177-unit high-end rental building located at 275 South 5 Street, Brooklyn.

These stops saw some of the largest rent drops on one-bedroom apartments

- 28 St – 6 Train – $3,635, YoY -11.3%

- 62 St – D/N – $1,550, YoY -8.8%

- 96 St – Q – $2,839, YoY -8.4%

- Fort Hamilton Parkway – D – $1,800, YoY -7.7%

- 34 St – Herald Sq – B/D/F/M/N/Q/R/W – $3,600, YoY -7.6%

These subway stops saw some of the most drastic rent jumps

- 36 St – D/N/R Trains – $2,200, YoY +10.1%

- Hewes St – J/M – $3,050, YoY +9.1%

- West 4 St – A/B/C/D/E/F/M – $3,556, YoY +7.9%

- 161 St – Yankee Stadium – 4/B/D – $1,995, YoY +7.8%

- Beverly Rd – Q – $2,041, YoY +7.4%

Methodology

To calculate the median net effective rents for the map above, we used RentHop’s rental data for one-bedroom apartments from March 16 through June 15, 2019 & 2020, MTA Lines and Stops data, and GIS data for subway stops compiled by CUNY – Baruch College. To get accurate prices near the subway stops, we looked at least 50 non-duplicated rental listings within half a mile of a subway stop and then calculated the median rents. If there were less than 50 non-duplicated listings, we expanded the distance to 1 mile of a subway stop.

Condensed Map for Easy Sharing – Click on the image for the full map!