When the pandemic first hit New York City, residents fled in droves, leaving countless apartments empty and flooding the rental market with sublets and lease breaks.

Today, it’s a completely different scenario. Two years into the pandemic, many have returned to the city they love the most, for work, for social life, and for many other reasons that make New York New York. Rental prices have recovered well beyond the pre-pandemic levels, and affordable rental inventory for many is hard to come by.

Post-pandemic changes to the MTA

The MTA system saw a similar shift. Over 90% of NYC’s subway riders disappeared during the pandemic. Now, the crowded cars and platforms show a stark difference. Subway ridership hit the highest single-day total on March 15 since the pandemic, and while the ridership is still not back to the pre-pandemic days, it’s fair to say that many people in NYC still rely heavily on the MTA system.

Proximity to the right trains means shorter commutes and more time spent doing what you love. But more importantly, choosing the right stop could potentially save you hundreds of dollars. How much can you save in 2022 by living one stop farther away from the city center? Let’s find out.

Our key findings this year include:

- One-bedroom median rents rose along 438 stops across all train lines. That’s over 90% of the MTA subway stops in New York City.

- Rents skyrocketed at major subway stops as concessions went away and gross rents soared with strong rental demand.

- In Manhattan, multiple stops experienced over 30% year-over-year growth, including 72nd St (1-2-3 trains, $3,495 / YoY 34.4%), 28th St (N-Q-R-W, $4,200 / YoY 33.3%), and Grand Central – 42nd St (4-5-6-6 Express, $4,025 / YoY 31.8%).

- In addition to reduced incentives, new developments also pushed up median asking rents at major subway stops.

- In Brooklyn, one-bedroom median rent rose 21.7% at Bergen St (2-3-4, $3,225) and 30.5% at Atlantic Av – Barclay Center (2-3-4-5, $3,775), partially due to two major new developments, 662 Pacific Street and 18 Sixth Avenue in Prospect Heights.

- In Queens, new buildings like 29-17 40th Avenue and Sven at 29-59 Northern Boulevard drove up prices along stops including 36th St (E-M-R, $2,658 / YoY 29.6%) and Queensboro Plaza (7-7 Express-N-W, $3,390 / YoY 28.6%)

- In the Bronx, the median price for one-bedroom apartments around Cypress Ave rose 19.4% to $2,269 as the Arches + NYC, a 190-unit new rental building, launched leasing.

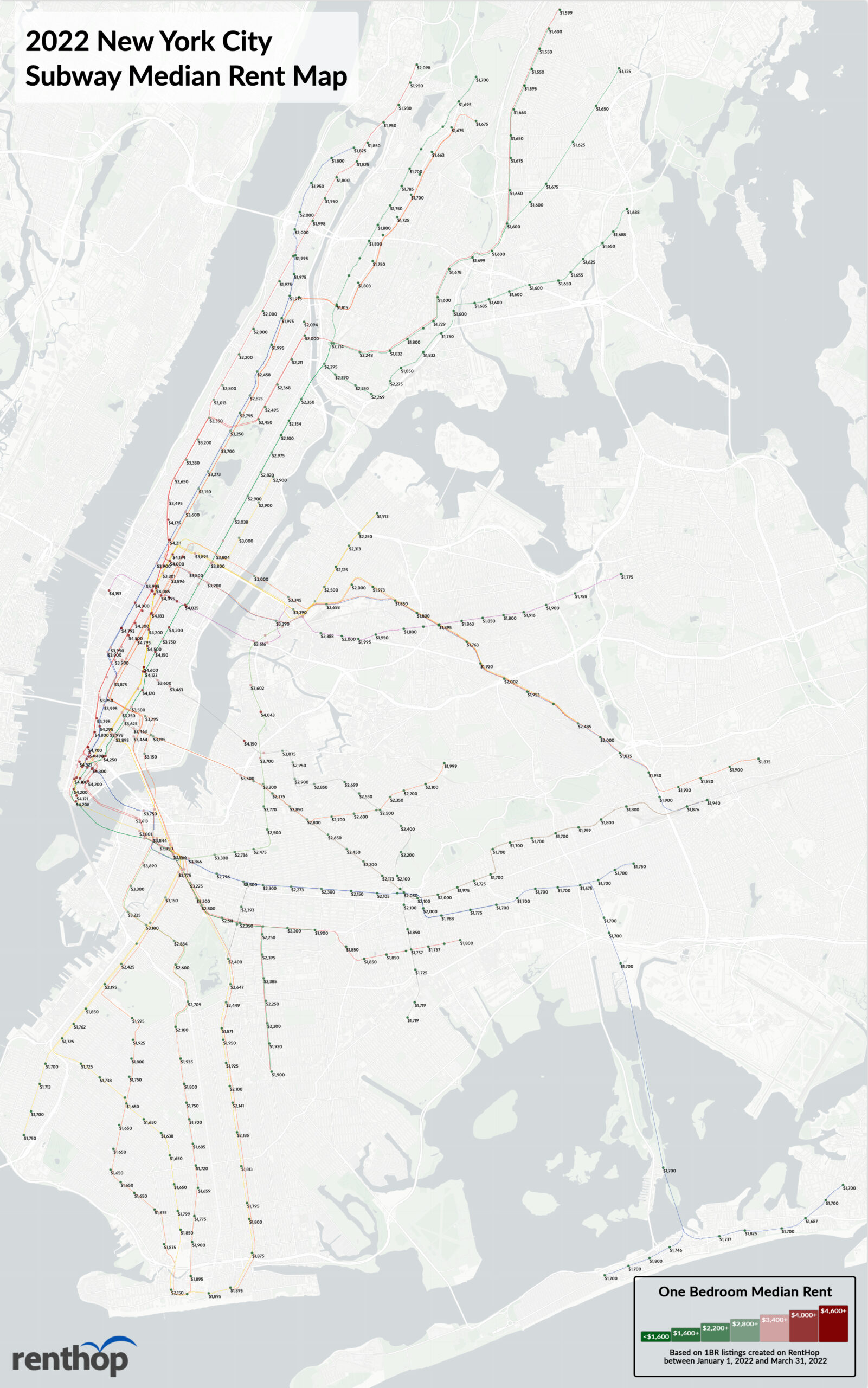

The Interactive Map Below Shows All Rents, Stops, and YoY Price Fluctuations

Looking at the map, we can see that stops experiencing more drastic year-over-year fluctuations are in neighborhoods saturated with high-rise luxury rental buildings. This is mostly due to landlords reducing the unprecedented concessions they were offering during the pandemic. In Midtown East, renters could get up to 3 months free at 150 E 44th Street on a 15-month lease. Now, not only has the gross rent increased, but the rent incentives are no longer as attractive. In Downtown Manhattan, buildings like 88 Leonard Street were offering up to 4 months free last year, and that kind of sweet deal no longer exists in the city.

Median 1BR Rents at Major NYC Subway Hubs

Living close to a major subway hub can drastically reduce your daily commute. If you have your heart set on living near one station, proximity to certain lines may give you a better deal.

- Union Sq – 14 St (N-Q-R-W) – $4,600, YoY +28.7%

- Union Sq – 14 St (4-5-6-6 Express) – $4,123, +19.5%

- Times Sq – 42 St (1-2-3) – $4,013, +30.6%

- Times Sq – 42 St (N-Q-R-W) – $4,116, +30.7%

- Grand Central – 42nd St (4-5-6-6 Express) – $4,025, +31.8%

- Grand Central – 42nd St (7-7 Express) – $4,050, +33.1%

- West 4th St (A-B-C-D-E-F-M) – $3,875, +24.2%

- Herald Sq – 34 St (B-D-F-M) – $4,187, +30.7%

- Herald Sq – 34 St (N-Q-R-W) – $4,200, +31.3%

- Fulton St (2-3) – $4,220, +29.8%

- Fulton St (4-5) – $4,300, +32.3%

- Fulton St (A-C-J-Z) – $4,300, +32.3%

- Jay St – Metro Tech (A-C-F) – $3,844, +26.8%

- Atlantic Ave – Barclay’s Center (2-3-4-5) – $3,775, +30.5%

- Atlantic Ave – Barclay’s Center (B-Q) – $3,725, +30.7%

- Atlantic Ave – Barclay’s Center (D-N-Q-R) – $3,775, +31.3%

- Broadway Junction (J-Z) – $2,100, +13.5%

- Broadway Junction (A-C) – $2,100, +15.2%

- Jackson Heights – Roosevelt Av (E-F-M-R) – $1,900, +5.6%

- 74 St – Broadway (7) – $1,895, +5.3%

Over 90% of MTA Stops Experienced Rent Hikes, a Stark Difference from last year.

After two years of uncertainty, the rental market has become more competitive than ever. Renters who locked in a lower rate during the pandemic may have found themselves lucky, as concessions go away and landlords try to recoup the loss they had accumulated since March 2020.

Compared to only 35 stops in 2021, this year, 438 stops, or 93% saw price increases, and many of those that exprienced the most significant changes are located in neighborhoods with large rental buildings that were offering concessions like two to four months free. Median one-bedroom rent jumped 33.9% to $3,700 at 96th St (A-B-C) , as buildings such as 792 Columbus Ave reduced the concessions from up to 3.5 months free to just one month free.

Gentrification remains a key driver of NYC rental prices, particularly in Brooklyn and parts of Queens. Median one-bedroom rent jumped 29.6% at 36 St (D-N-R) to $2,658. This fluctuation, in addition to reflecting reduced concessions, is likely due to Sven, a 958-unit new development launched early this year located at 29-59 Northern Boulevard. Meanwhile, median one-bedroom rent rose 31.4% at Kosciuszko St (J) and 30.3% at Myrtle Ave (J-M-Z), respectively, partially driven by 668 Bushwick Avenue, a new six-story mixed-use building designed by Genaro Urueta.

These stops saw some of the largest rent hikes on one-bedroom apartments

- 72 St (1-2-3) – $3,495, YoY +34.4%

- 103 St (1) – $3,350, YoY +34.3%

- Grand Central – 42 St (S) – $4,141, YoY +33.9%

- 96th St (A-B-C) – $3,700, YoY +33.9%

- High St (A-C) – $3,750, YoY +33.9%

Rents dropped at these stops

- Bedford Park (4) – $1,700, YoY -2.9%

- Jackson Ave (2-5) – $1,832, YoY -2.3%

- Kingsbridge Rd (B-D) – $1,663, YoY – 2.2%

- Elmhurst Ave (E-M-R) – $1,763, YoY -2.1%

- Zerega Ave (6-6 Express) – $1,655, YoY -1.2%

Methodology

To calculate the median net effective rents for the map above, we used RentHop’s rental data for unfurnished one-bedroom apartments from January 1 through March 31, 2021 & 2022, MTA Lines and Stops data, and GIS data for subway stops compiled by CUNY – Baruch College and NYC Open Data. To get accurate prices near the subway stops, we looked at least 50 non-duplicated rental listings within 800 meters (0.5 miles) of a subway stop and then calculated the median rents. If there were less than 50 non-duplicated listings. If not, the radius from the stop was increased to up to 2,000 meters (1.2 miles) and the data was resampled to ensure enough unique listings were used when calculating the median.

Tell Your Friends! Here’s A Condensed Map for Easy Sharing